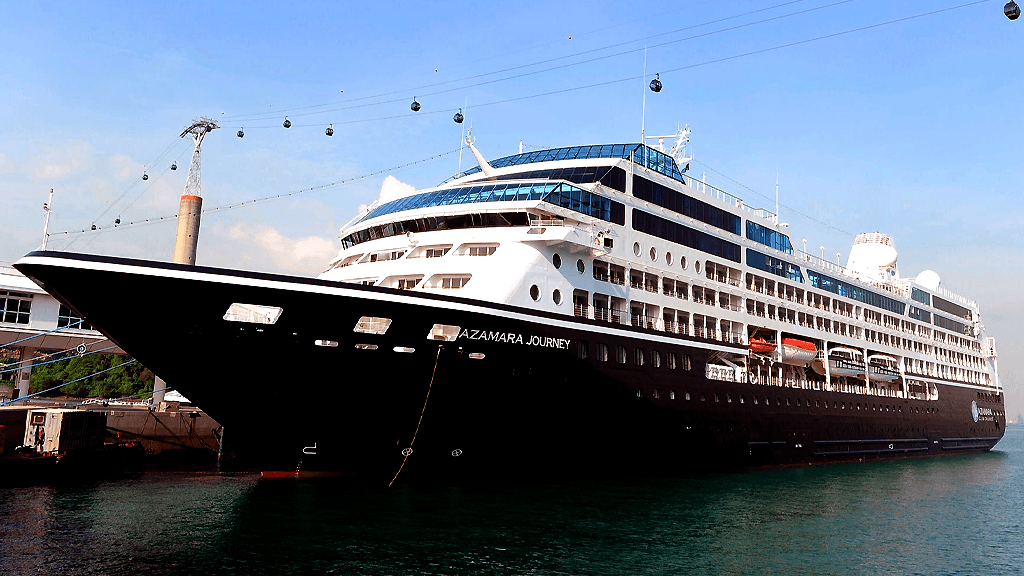

Royal Caribbean Group enters definitive agreement to sell Azamara Brand

Royal Caribbean Group (NYSE: RCL) today announced it has entered into a definitive agreement to sell its Azamara brand to Sycamore Partners, a private equity firm specializing in consumer, retail and distribution investments, in an all-cash carve-out transaction for $201 million, subject to certain adjustments and closing conditions. Sycamore Partners will acquire the entire Azamara brand, including its three-ship fleet and associated intellectual property. The transaction is subject to customary conditions and is expected to close in the first quarter of 2021.

Royal Caribbean Group noted the transaction allows it to focus on expanding its Royal Caribbean International, Celebrity Cruises and Silversea brands.

«Our strategy has evolved into placing more of our resources behind three global brands, Royal Caribbean International, Celebrity Cruises and Silversea, and working to grow them as we emerge from this unprecedented period,» said Richard D. Fain, Chairman and Chief Executive Officer of Royal Caribbean Group. «Even so, Azamara remains a strong brand with its own tremendous potential for growth, and Sycamore’s track record demonstrates that they will be good stewards of what the Azamara team has built over the past 13 years.»

«We are pleased that Royal Caribbean Group has entrusted Sycamore to support Azamara in its next phase of growth,» said Stefan Kaluzny, Managing Director of Sycamore Partners. «We are excited to partner with the Azamara team and build on their many years of success serving the brand’s loyal customers. We believe Azamara will remain a top choice for discerning travelers as the cruising industry recovers over time.»

Azamara’s value proposition and operations will remain consistent under the new arrangement, and Royal Caribbean Group will work in close collaboration on a seamless transition for Azamara employees, customers and other stakeholders. In conjunction with the transaction, Azamara Chief Operating Officer Carol Cabezas has been appointed President of the brand.

The transaction will result in a one-time, non-cash impairment charge of approximately $170 million. The sale of Azamara is not expected to have a material impact on Royal Caribbean Group’s future financial results.

Perella Weinberg Partners LP served as financial advisor to Royal Caribbean Group and Freshfields Bruckhaus Deringer LLP provided legal counsel. Kirkland & Ellis LLP provided legal advice to Sycamore Partners.

848121 87002Interesting blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple tweeks would really make my blog jump out. Please let me know where you got your design. Thanks a lot 367919

415805 827134I like this internet web site because so significantly utile stuff on here : D. 971724

stress relief

580790 452216Numerous thanks I ought say, impressed with your website. I will post this to my facebook wall. 235611

201873 884593Beneficial information and excellent design you got here! I want to thank you for sharing your tips and putting the time into the stuff you publish! Great function! 435189

876112 290888Properly written articles like yours renews my faith in todays writers. Youve written details I can finally agree on and use. Thank you for sharing. 713844

3400 475813Some genuinely good and utilitarian info on this internet web site , also I believe the style and style holds great capabilities. 292529

466504 561930View the following suggestions less than and uncover to know how to observe this situation whilst you project your home business today. Earn cash from home 441170

131442 706365Maintain all of the articles coming. I adore reading by means of your things. Cheers. 909181

251182 646979Exceptional weblog here! In addition your web internet site rather a good deal up rapidly! What host are you using? Can I get your affiliate hyperlink for your host? I wish my web site loaded up as fast as yours lol. 881406